Dr. Salman Ghouri and Areeba Ghouri, June 18, 2012

Everyone is familiar by now with the unconventional (shale) gas revolution in the US, which has transformed US and global gas markets. Less well known to the wider public is that an unconventional (shale) oil revolution is also gathering pace, with equally far-reaching implications. It is not unlikely that the US, the world’s largest crude oil importer, could go a long way towards self-sufficiency by 2035. This would drastically change the global energy equation.

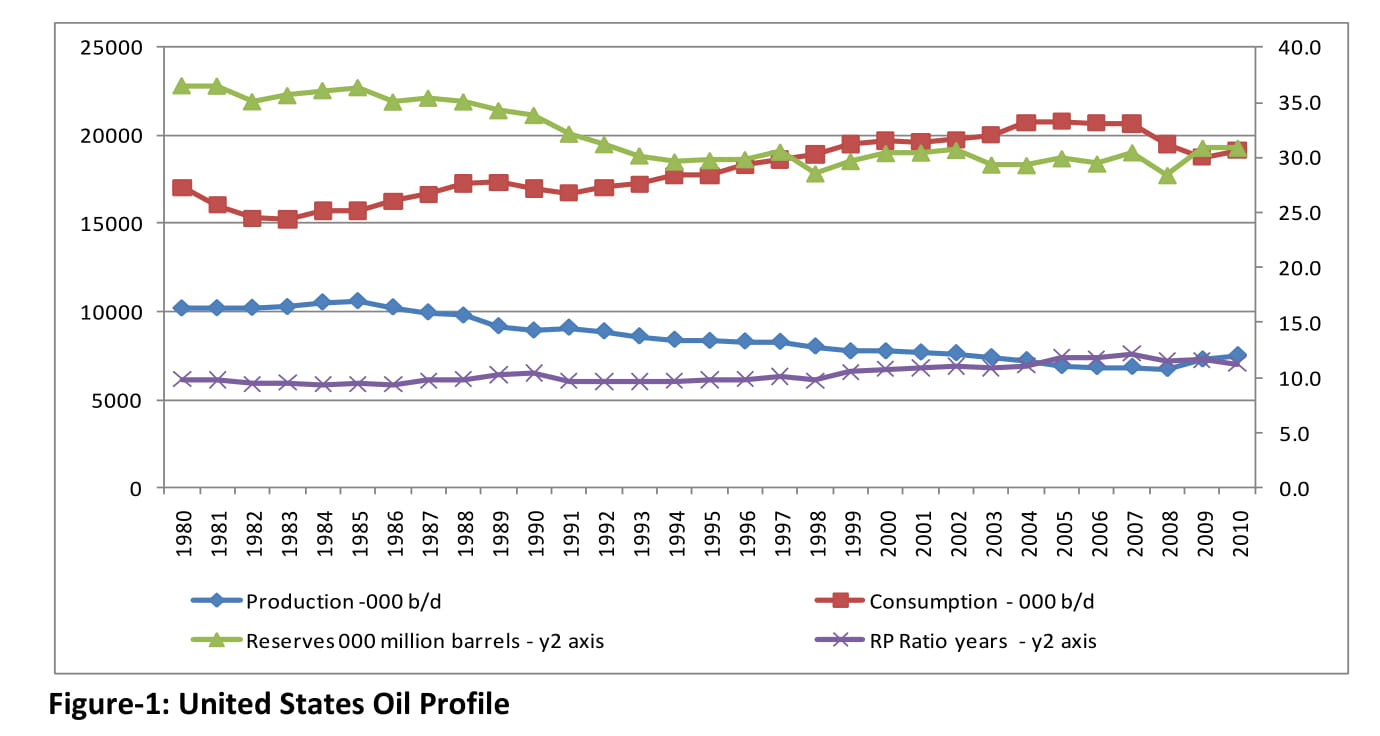

After many years of steady decline, US oil reserves recorded a sudden boost in 2009 (figure 1). Similarly, US oil production went up after years of gradual decline, and has grown quite rapidly over the last three years.

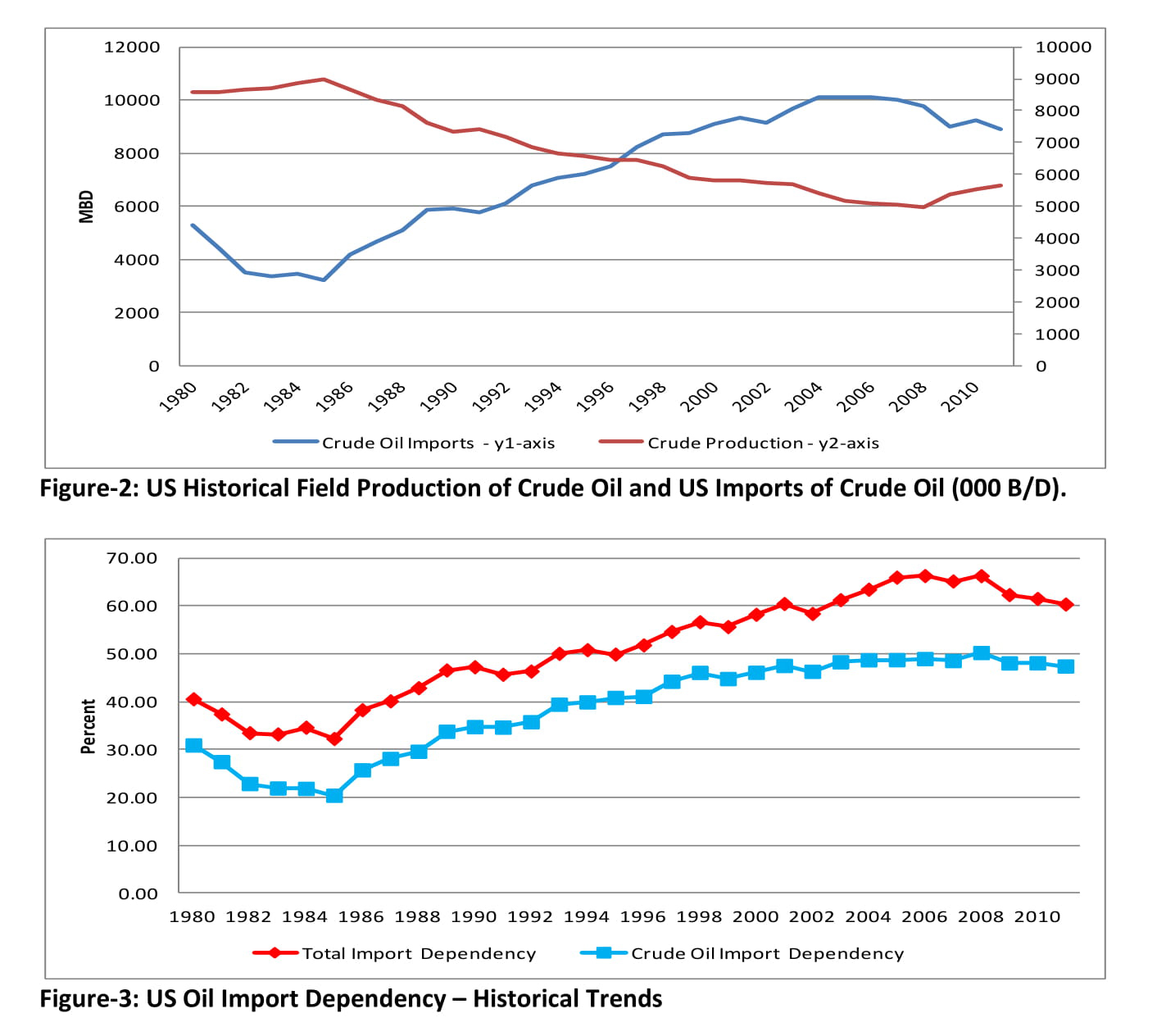

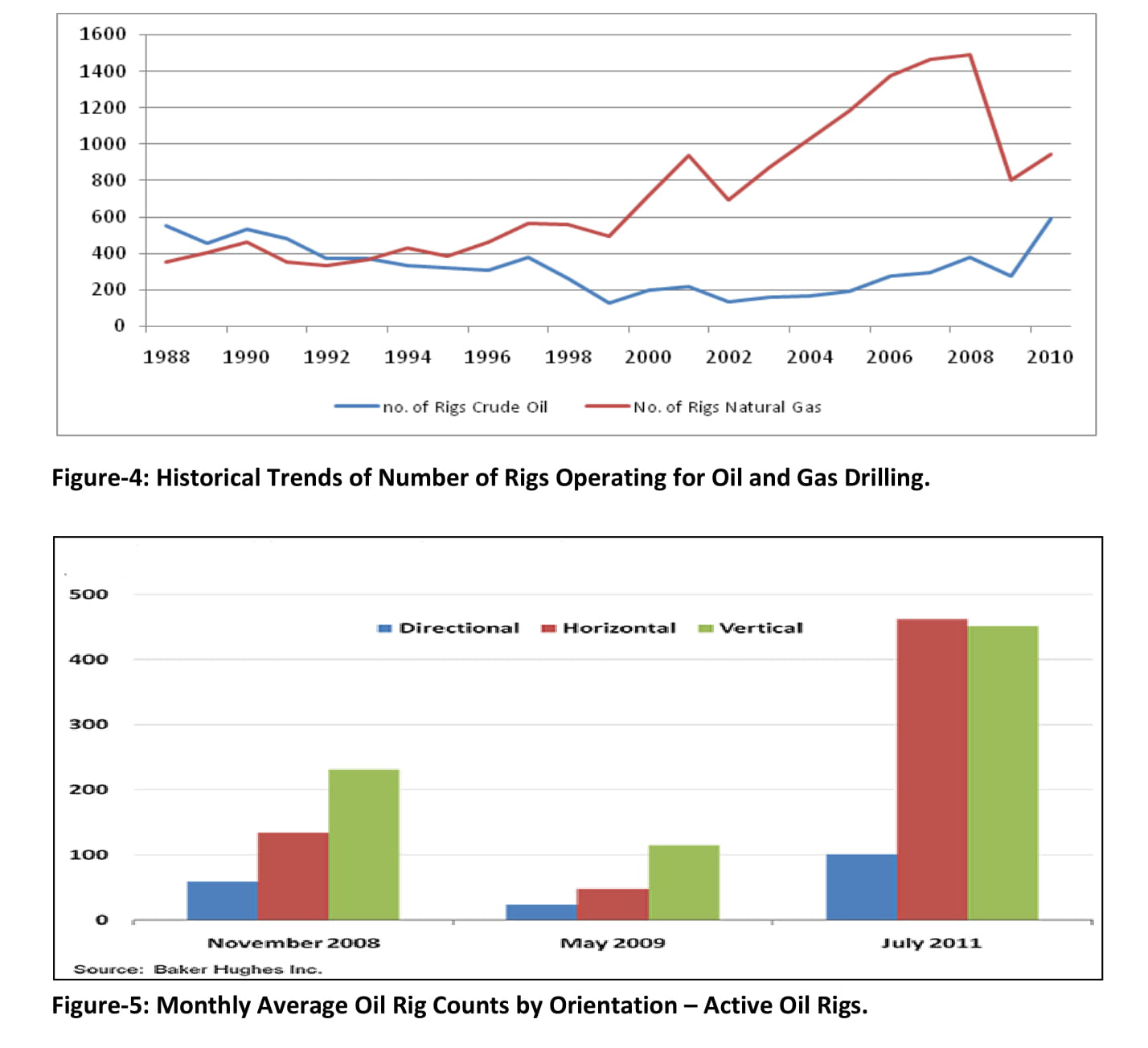

Thanks to this increase in domestic oil (shale oil and shale gas condensate) production and also a reduction of oil consumption, US oil import dependency has also gone down in recent years. (Figures 2 & 3). After peaking in 2006 at over 66 per cent, overall US oil import dependency declined to about 60 percent in 2011. Import dependency for crude oil was down to 47.36 percent at the end of 2011 from about 50 percent in 2008. During most of the eighties, US crude oil import dependency was between 20 and 30 per cent before rapidly moving upward.

So what happened? Through the use of technology, US oil and natural gas operators are converting previously uneconomic oil and natural gas resources into new proved reserves and production. Shale oil has historically been difficult and costly to produce because it is found in formations characterized by both low porosity and low permeability. The technology first used to extract natural gas from shale rock in the Marcellus and other shale gas plays has now been fine-tuned and modified to extract oil from shale formations across the country, such as theMonterey play in California, the Barnett and Eagle Ford in Texas, and most notably the Bakken in North Dakota.

At the Barnett in Texas, overall liquids production more than doubled (and production from horizontal wells swelled roughly six-fold) from 2005 to 2010. Production from Woodford in Oklahoma surpassed 2750 barrels per day (b/d) in 2009, up 83 percent compared to 2008. At the Eagle Ford, where the first well was drilled only three years ago, liquids production in 2009 grew more than five-fold over the previous year, and is expected to produce more than five million barrels in 2010. Liquids production from the Marcellus shale nearly quadrupled in 2009 and is expected to show another considerable increase in 2010.

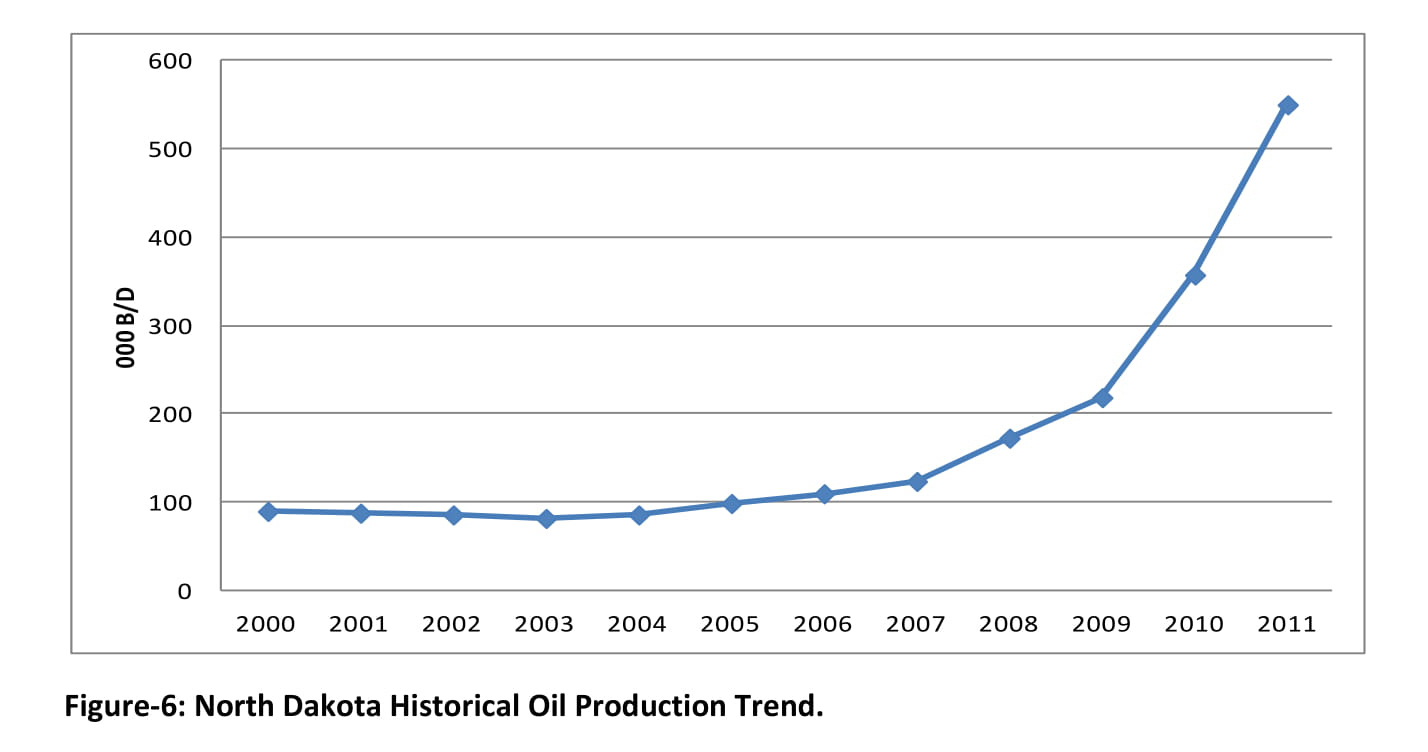

As the number of oil rigs drilling horizontal wells increased during 2010, oil production from shale oil reserves is likely to further increase during 2010 and beyond (figure4). The increase in the horizontal rig count is an effective gauge of unconventional drilling in liquids-rich portions of US shale formations. After declining by nearly two-thirds from November 2008 to May 2009 (due to the collapse of oil prices from $147/barrel in July 2008 to below $40/barrel in December 2008), the number of horizontally-directed oil rigs showed strong growth once more

(Figure 5).

No doubt the most sensational development to date has taken place in North Dakota. This has been an oil producing state for the last 60 years. However, the Bakken oil boom that started three years ago has turned North Dakota into the fourth largest oil producing state in the country and one of the largest onshore plays in the United States. The Bakken extends beyond North Dakota into Eastern Montana and the neighboring territories of Saskatchewan and Manitoba in Canada. While its success has been largely attributed to advances in oil field technology, primarily horizontal drilling and hydraulic fracturing, a number of circumstances have come together to make the Bakken a successful oil play, including high oil prices and widespread and ready access to privately held prospects.

Figure-6 depicts North Dakota oil production trends since 2000. Total oil production has approximately tripled since 2005, from 98,000 b/d to over 550,000 b/d in 2011 (out of this total, Bakken accounted for 490,000). Most experts anticipate that the field could produce a million barrels daily by the end of 2020. To compare: total US production was 7.8 million b/d in 2011 and a country like Norway produces 2 million b/d.

It is not certain how long North Dakota could produce at this level. According to the United States Geological Survey (USGS) there are at least 4 billion barrels of recoverable oil in North Dakota; other estimates indicate 4-5 times more.

So what are the future prospects of US oil production? Is it possible that the country will be able to eliminate its reliance on oil imports in the future, or even become an oil exporter? And how would this affect the global supply/demand balance and oil prices?

If we look at the geological potential of the country, especially in Texas, Utah, Colorado, North Dakota, Alaska and some other parts, self-sufficiency does seem possible, though this would depend on several factors, such as supportive government policies, development of technology and the level of investment both upstream and downstream. Huge upfront investments are required to enhance domestic oil production. These are typically driven by the prospects of profitability, which depend largely on oil prices, and government policies such as the opening up of new prospects.

Currently there is a favourable combination of high oil prices and supportive government policy. In his most recent State of the Union address, President Obama directed the Department of the Interior to finalize a national offshore energy plan that would make three quarters of potential offshore resources available for development by opening up new areas for drilling in the Gulf of Mexico and Alaska. “Over the last three years, we have opened millions of new acres for oil and gas exploration, and tonight, I am directing my administration to open more than 75 percent of our potential offshore oil and gas resources”, said Obama.

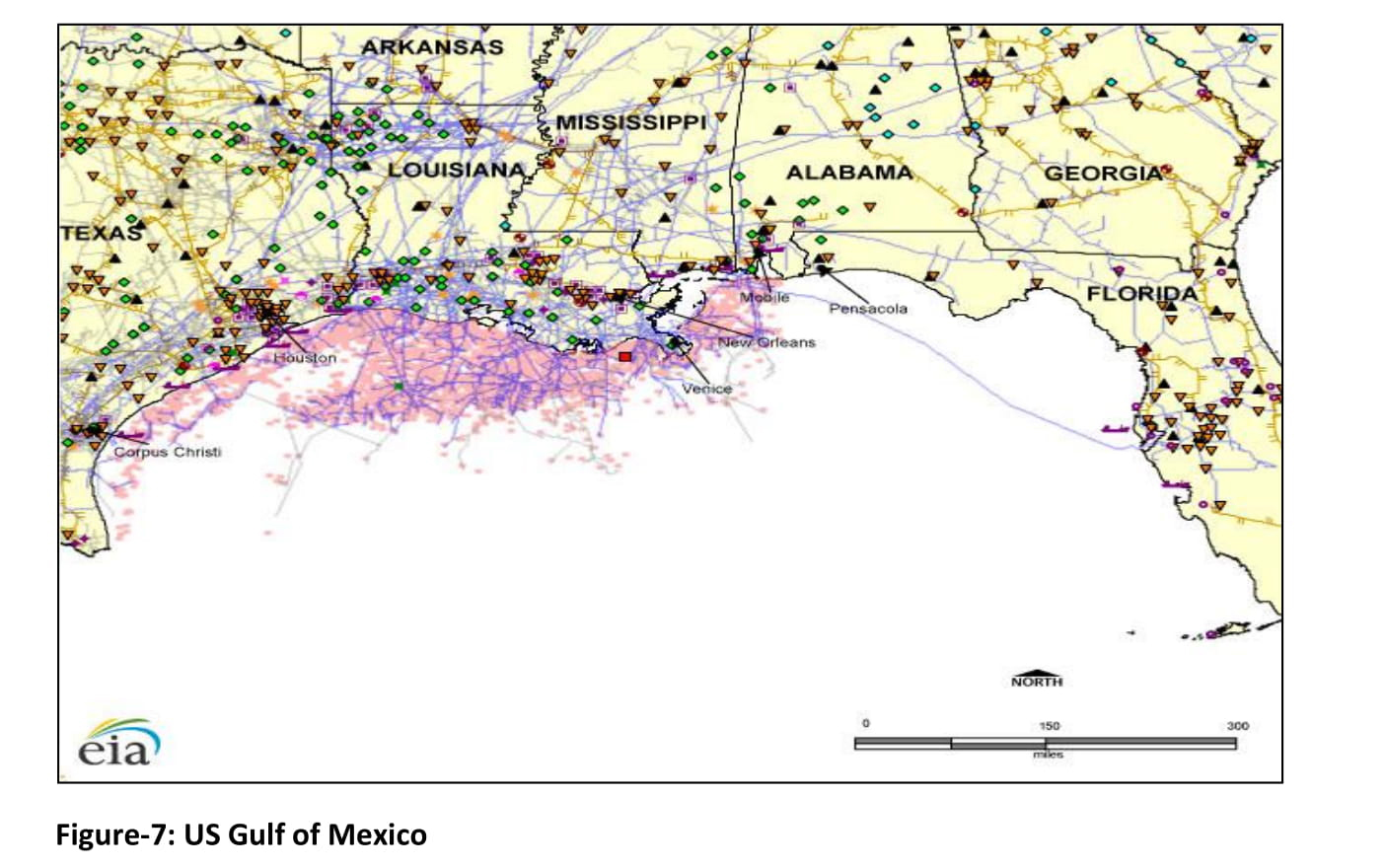

Tommy Beaudreau, Director of the Bureau of Ocean Energy Management, has said that the Central Gulf of Mexico (see Figure 7) remains the area with the greatest offshore oil and gas potential in the entire United States outer continental shelf. The intention of the US government is to make this area available for development.

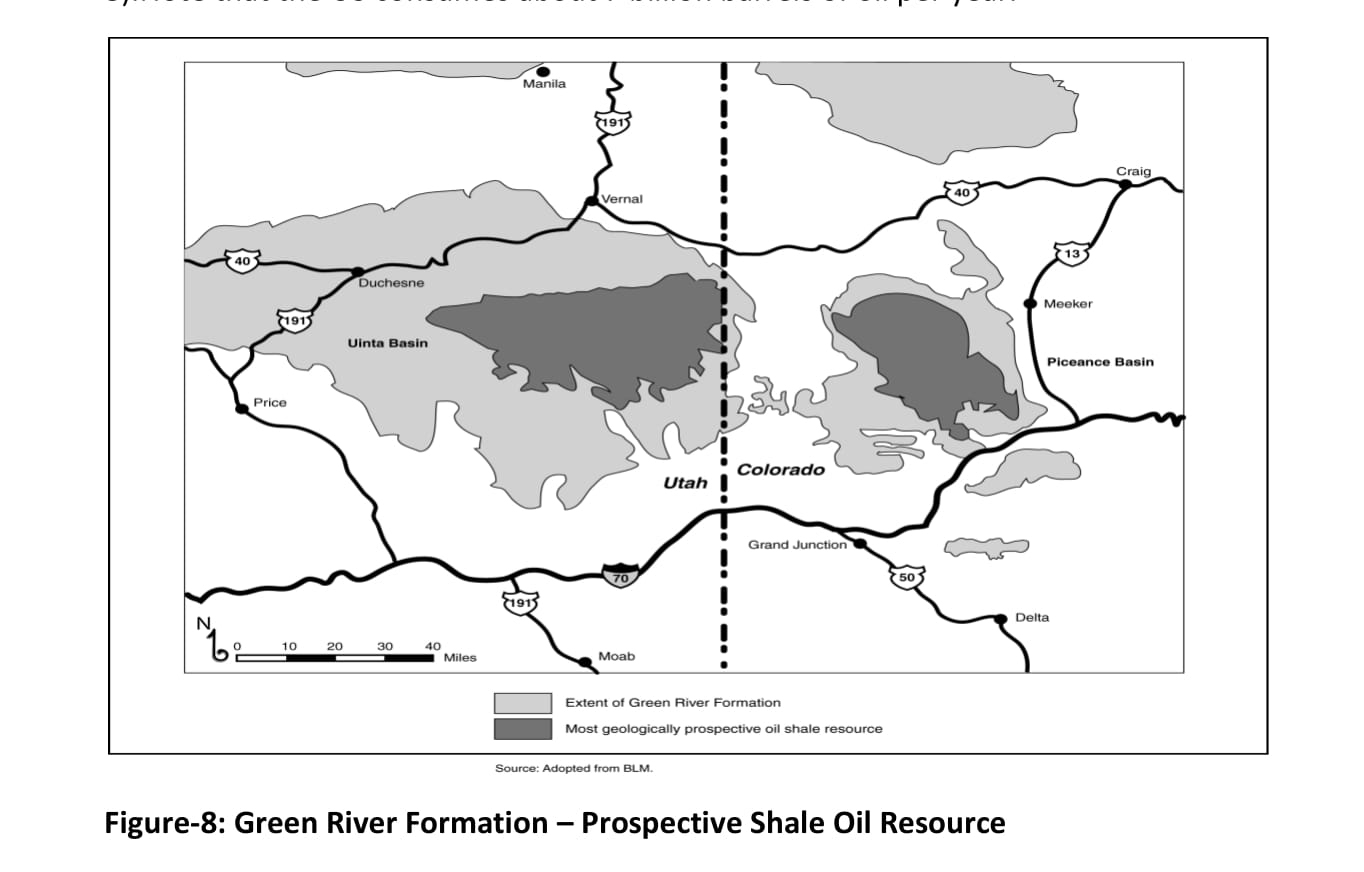

In addition to opening up of new potential acreage for conventional drilling, there are a lot of potential prospects for shale oil penetration. We have discussed some of the shale oil prospects and their recent successes, but the story of US shale oil does not end there. There is, for example, the Green River Formation (mainly in Colorado and Utah). According to estimates from the USGS, this contains about 3 trillion (3,000 billion) barrels of oil, about half of which may be recoverable, depending on the available technology and economic conditions (Figure 8).Note that the US consumes about 7 billion barrels of oil per year.

If the United States is able to commercially exploit part of these resources and combine this with successfully exploiting conventional oil resources in new offshore prospects, it is quite possible for the country to substantially reduce its oil import dependency and perhaps even achieve self-sufficiency by 2035. According to figures from consultancy PFC Energy, oil companies are investing an estimated $25 billion this year to drill 5,000 new oil wells in tight rock fields in the US. Energy consultancy IHS CERA foresees that, based on production plans from industry, unconventional oil production could rise from about half a million barrels per day now to 3 million barrels per day in 2020. Daniel Yergin, chairman of IHS CERA, has said: “This is like adding another Venezuela or Kuwait by 2020, except these tight oil fields are in the United States.”

However one should not ignore the one element of uncertainty that could completely change the whole scenario, namely the oil price. Generally, a crude oil price of $60 per barrel is considered to be a breakeven price to produce shale oil, although this may vary quite a bit from one region to the other. If the oil price collapsed to below $60 per barrel the US could probably not develop its shale and tight oil resources profitably. Then again, it would have less need to do so either.

Another factor to consider is whether the US shale oil story could be replicated in China, India and other oil-importing countries. That would affect the global oil demand/supply balance even more. If this happened, the question is how OPEC would react. It could be in the interest of OPEC to already increase its production now and allow oil prices to decline to below $60 to discourage further development of shale oil.

To conclude, the potential of both conventional and unconventional oil production in the US is quite significant and one could expect that by 2035, if backed by sound policies, US oil import dependency would be substantially reduced. This means that crude oil meant for the US will look for other markets. If countries like China and India could also increase their oil production, substantial supplies would become available for the rest of the world. The likelihood of this to happen will depend a lot on the development of the oil price. Environmental considerations may also come into play if hydraulic fracturing would damage water aquifers. In that case another technological breakthrough would have to occur to make another unconventional oil revolution possible.

The author is Senior Economist at Qatar Petroleum, Doha, Qatar. The views, findings, interpretations, and conclusions expressed in this paper do not necessarily reflect the views of Qatar Petroleum. Areeba Ghouri is Economics student at University of North Texas, USA.

Published in European Energy Review June 18, 2012